It seems that all the application of technology in China can not escape the rules of innovation, marketization, disorderly competition, barbaric growth, market elimination, standardized management and orderly development. Power lithium batteries are also the same.

Based on the policy orientation of the national integration industry, it is not easy for start-ups to occupy a stable seat in the power battery industry, both in terms of capacity and technology. Start-ups can change their mindset and focus on the sub-sectors of the industry chain with relatively low thresholds and relatively few competitions.

Adjustment policy, survival of the fittest

At the end of 2014, new energy vehicles were upgraded to national strategies, directly driving the production and sales of power batteries. Benefiting from the policy dividend, the total number of new lithium- powered lithium-ion batteries with production in January-October 2016 reached 13.9GWh, an increase of 78% compared with the same period last year. However, the former policy is relatively loose, the standard system is not perfect, a large number of battery companies are growing wildly, security incidents are frequent, and opportunistic companies use policy gaps to defraud state subsidies.

The contradiction between the rapid development of the market and the inability of actual technology to catch up has caused concern and concern from consumers, enterprises, governments and other sectors. In order to standardize the development of the industry, the government introduced a series of adjustment policies in 2016. It hopes that through the regulation, management and regulation of enterprises on the market, the survival of the fittest will gradually generate several “oligarch†enterprises from product technology and after-sales service, leading This industry is moving towards health.

In 2016, the government released and adjusted the access and subsidy policies for the power battery industry. These two policies are most relevant to the interests of enterprises, thus triggering the nerves of the entire industry chain. According to the policy trend of adjustment, it can be expected that the knockouts in the power lithium battery industry will be opened soon, and the state will help eliminate backward production capacity and concentrate on developing resources to develop advanced enterprises.

1. Improvement of battery product quality and capacity

The battery quality and production capacity of the company are closely related to the subsidy policy. For the existing large-scale power battery companies, it is a good opportunity to catch up with foreign companies, further establish market position and expand customers. For companies with low production capacity and low product quality, and relying on low prices to seize the market, they face the result of being merged or eliminated.

From the end of 2015 to the middle of 2016, a total of 57 batches of 57 companies entered the “Catalogue Conditions for Automotive Power Battery Industry†catalogue. It is worth noting that there are two points. First, the battery companies in the catalog are expected to seize more orders. Second, the international battery manufacturers have not entered the catalog, and domestic battery manufacturers have the opportunity to overtake.

In terms of expanding orders, in theory, the terminal car factory uses the batteries in the catalogue to meet the subsidy requirements of the Ministry of Industry and Information Technology, and can apply for subsidies from the Ministry of Industry and Information Technology. The batteries that are not in the catalogue are not subsidized. However, the Ministry of Industry and Information Technology said that the subsidy for new energy vehicles is related to the battery catalog, but it will not be simply linked, and the future catalogue will be released according to the operation process according to the company's declaration. However, for many new energy vehicle companies, it is still possible to give priority to the battery companies that enter the catalog.

The curve overtaking international manufacturers are because Samsung SDI, LG Chemical and other battery giants have not entered the corporate directory, their market share in China's power lithium battery market is more than half, and the cooperative customers are also well-known car companies. LG Chem's current customers in the Chinese market include SAIC, Great Wall Motor, and Chery Automobile. Samsung SDI's customers in China include Jianghuai, Beiqi New Energy, Yutong Bus, and Foton Motor. Some industry insiders believe that the international battery giant has not entered the corporate directory, which is the market protection established by the government for domestic enterprises. However, it is foreseeable that this restriction will not last long. Only by continuously upgrading technology and reducing costs can we fundamentally establish market protection for ourselves.

Another strong response policy is that in November this year, the Ministry of Industry and Information Technology announced the "Guidelines for the Standardization of Automotive Power Battery Industry" (2017). It stipulates that "the annual production capacity of lithium-ion power battery cells enterprises is not less than 8GWh", while the annual production capacity threshold of lithium-ion power battery cells companies has been set at 0.2GWh, and the threshold has increased to 40 times. What is the concept of 8GWh? According to the research data of Essence Securities, BYD's existing production capacity is 10GWh in 2016, and the production capacity will reach 16GWh by the end of the year. The Ningde Times New Energy Technology will have a capacity of 6GWh in 2016, and the capacity will reach nearly 8GWh by the end of the year. It can reach the capacity requirement of 8GWh. Although the Ministry of Industry and Information Technology said that the "Draft for Comment" is not a rigid requirement, and there is no written indication that it will be linked to the subsidy policy, this policy will inevitably promote the expansion of production and mergers and acquisitions of leading enterprises with production capacity standards or fast-reaching standards.

According to industry analysts, this policy aims to alleviate the “structural supply shortage†phenomenon of leading enterprises, and at the same time eliminate the rear enterprises with limited production capacity. In the case of overall overcapacity, why is it that the power lithium battery products of leading enterprises such as Ningde Times and Guoxuan Hi-Tech have experienced a “structural supply shortage� According to the research data of the High-Tech Research Institute of Lithium- Ion Research Institute (GGII), there are currently more than 140 power lithium battery companies in China (including under construction). The output of power lithium batteries in the first three quarters was 19.3GWh, and the actual shipments were 17.2GWh. By the end of 2016, the national power lithium battery planning capacity will reach 60GWh, but it is estimated that the annual power lithium battery shipments will be only 26GWh, and a large amount of production capacity will be idle or vacant. The capacity of idle or short-selling is mostly low-end products, and the power lithium battery enterprises that can meet the technical requirements of downstream enterprises are only the leading ones, and their production capacity cannot fully meet the market demand.

The improvement of the power lithium battery capacity threshold is a good one for many companies. For leading enterprises, it is a good opportunity to expand production capacity and compete for orders. In October 2015, the Ningde era launched a 10GWh power lithium battery capacity project. The current production capacity of AVIC Lithium Battery is about 0.9GWh. The first phase of AVIC Lithium Power (Luoyang) Phase III and China National Aviation Corporation Lithium Power (Jiangsu) is expected to be gradually completed by the end of 2016 to the beginning of 2017, which will produce 1.5GWh and 2.5GWh respectively. The second phase and the third phase of AVIC Lithium (Jiangsu) will be launched in 2016 and 2017. The overall planning target is expected to be completed in 2017. The annual production capacity of 12GWh power lithium battery will be formed. BAK has also established a market expansion plan that is compatible with the market. In 2016, it has achieved a capacity of 6.5GWh, and in 2017 will achieve 8GWh capacity. In 2020, it will complete 15GWh capacity deployment. In 2016, Miaosheng Power has laid a 6GWh power lithium battery plant in Changsha, Hunan, and the 6GWh plant in Shenyang, Liaoning has been completed. Together with the original planned production capacity, the total annual production capacity can reach 13GWh. Two production lines of Yiwei Lithium Energy's ternary material power lithium battery Phase I (1GWh) project have started production. Guoxuan Hi-Tech has expanded the capacity of Sanyuan Power Lithium Battery in advance. After the completion of its Hefei Phase III and Qingdao Plants, the production capacity of Guoxuan Hi-Tech's ternary power lithium battery will further increase in the third quarter of this year.

2. The threshold for financial subsidies will increase and the amount will fall back.

In addition to the increase in access thresholds, the power battery industry has also ushered in the “news†of subsidies for new energy vehicles and the “depletion†of subsidies. The core of subsidies for new energy vehicles is to subsidize power batteries. The reduction in subsidies and the increase in subsidies will require power battery companies to quickly improve product quality while reducing costs.

Although the heart of the company is rejected, the result is not sudden. In 2016, the new energy vehicle enterprises "cheat up" incidents made a lot of noise, a large number of enterprises do not think ahead, only research and development for subsidies, and even there are cars without electricity or even cards without car. Several new energy bus companies involved in the “cheat†incident have also been announced, including many “high-quality passenger carsâ€.

The "cheat incident" may only be counted as a fuse for subsidies, and the underlying reason is that the government hopes to concentrate financial resources on the one hand to support the rapid development of truly technology-based enterprises. On the other hand, we also want to reduce policy orientation and let market feedback determine the development of the industry.

On the last working day of 2016, the official website of the Ministry of Finance issued the Notice of the Ministry of Finance and Industry Ministry of Industry and Information Technology Development and Reform Commission on Adjusting the Financial Subsidy Policy for the Promotion and Application of New Energy Vehicles (hereinafter referred to as “Noticeâ€). The "Notice" has raised the subsidy threshold for new energy vehicles (specifically, the vehicle energy requirements, driving mileage, compliance with the new national standard for power lithium batteries, safety requirements, etc.), established a penalty mechanism, and the subsidy amount has declined. Specifically, the local financial subsidy must not exceed 50% of the central government's bicycle subsidy; except for fuel cell vehicles , the central and local subsidy standards and caps for various models from 2019 to 2020 will fall 20% on the basis of current standards.

In the newly released policy, the subsidy for new energy buses will be greatly reduced. The national subsidy limit for non-fast charge type pure electric buses is 300,000 yuan/unit, and the subsidy limit for fast charge type pure electric buses is 200,000 yuan/unit. The national subsidy for hybrid vehicles (including extended-program) buses is capped at 150,000 yuan per vehicle. Previously, the highest subsidy in the country was 500,000 yuan per vehicle. The subsidy for pure electric passenger cars basically fell back by 20%. Among them, the national subsidy ceiling for pure electric passenger cars has dropped from the previous 55,000 yuan / vehicle to 44,000 yuan / vehicle, and the subsidy ceiling for plug-in hybrid passenger vehicles (including the extended program) has been reduced from 30,000 yuan / vehicle. To 24,000 yuan / vehicle.

Subsidy subsidies, the power battery industry is bound to reshuffle, it is reported that there are already vehicle manufacturers that require battery manufacturers to cut prices by 35% to 40% next year. At the same time, according to industry insiders, in order to make the subsidies more precise, the four ministries and commissions of the Ministry of Industry and Information Technology proposed that the subsidies for the purchase of new energy vehicles should be changed from ex ante to post-liquidation. Previously, many power battery companies have clearly indicated in their financial reports that because of the delayed issuance of subsidies, there is a problem of “returning moneyâ€. If the subsidy is changed to after-the-fact liquidation, the capital chain of the new energy auto companies will be tightened, which also puts more stringent requirements on the payment conditions and product quality standards of the power battery companies.

What are the entrepreneurial opportunities in the power lithium battery industry?

Under the challenge, if the startups continue to enter the competitive landscape of the battery main body, they need a lot of capital and technology investment, and the chances of winning are slim. Instead of sticking to the battery body, start-ups can look for opportunities in the industry chain, such as battery separators and battery management systems.

On the one hand, although the development of the lithium battery industry is good, unfavorable factors such as raw material price fluctuation risk and gross profit decline still exist. The low-end overcapacity and market competition in the lithium battery industry are intensifying, and the subsidy threshold is greatly improved, and the industry concentration is increased. Large, short-term market risks are also relatively large. On the other hand, the battery separator and battery management system are technically weak links in the domestic power lithium battery industry. The “Guidelines for Foreign Investment Industry Guidance Catalogue†is for the production of automotive electronics and new energy vehicle batteries. The access restrictions are limited, and the battery-related items include only battery separators (thickness 15-40μm, porosity 40%-60%) and battery management system. The state encourages foreign investment, intending to change technology through the market. Make up for shortcomings in domestic technology as soon as possible.

1, lithium ion battery separator

In the era of 3C lithium battery, the domestic diaphragm market is a small market of more than one billion. The outbreak of power battery will lead the domestic diaphragm market to the big market of 10 billion level, and it has also been supported by China's industrial policy and funds.

Lithium-ion battery separators are the key materials for lithium-ion batteries. The cost is about 10%-20% of the cost of lithium-ion batteries, and the gross profit margin is 50%-60%. It is considered to be the most investment value in the lithium battery industry chain. One of the industries. The diaphragm industry has a high technical content, and the mid-to-high-end market has long been monopolized by companies such as Asahi Kasei of Japan, Toho Chemical of Japan, and Celgard of the United States. Domestic lithium-ion battery separators are in a fierce competition in the low-end market and insufficient supply in the middle and high-end markets. For battery separator companies, high-end products are a promising way out.

Among the domestic diaphragms sold in 2014, Zhongke Technology, Xingyuan Materials and Jinhui Hi-Tech accounted for 52% of sales. Among them, Zhongke Technology and Jinhui Hi-Tech are the oldest diaphragm manufacturers, and their shipments in the diaphragm field have remained the top three in the industry. However, in the environment of continuous breakthrough and increased competition in diaphragm technology, its technology is relatively stagnant, and its overall competitiveness is The decline. Star source material is the highest domestic company with dry diaphragm and wet diaphragm. It has strong competitiveness in product, technology and channel construction. Customers include LG Chem, BYD, Tianjin Lishen, AVIC Lithium, Wanxiang Group, etc. .

There are currently five listed diaphragm companies in the New Third Board, including Hongtu diaphragm, Huiqiang New Materials, Newmi Technology, Xucheng Technology, and Jinli. According to the 2015 financial data, in addition to the Hongtu diaphragm, the other four companies are losing money. According to the financial report for the first half of 2016, the business conditions of these five companies have improved. The main reasons are the increase in market demand, technological innovation, and expansion.

The entrepreneurial opportunities in the diaphragm industry are concentrated in the mid- to high-end products market, and the trend of wet diaphragms replacing dry diaphragms has gradually become clear. However, the pre-production equipment of the battery separator has been invested heavily, and the product needs to have a promotion period from the sample to the mass production, and the production capacity cannot be effectively utilized.

2, lithium battery electrolyte

The demand for lithium battery electrolyte is large, the electrolyte accounts for about 12% of the cost of lithium ion battery, and the gross profit margin is about 30% to 40%. It is one of the strong profitable links in the lithium battery industry chain. The core competitiveness of the electrolyte company lies in the formulation of additives as the core. The barriers to entry in the industry are extremely high, and it takes a long time to accumulate technology. The investment threshold is not high. The investment capacity of 5,000 tons of electrolyte is about 100 million yuan.

And with the explosive growth of new energy vehicles, in 2015 China's lithium-ion battery electrolyte shipments were 63,300 tons, an increase of 48.9% year-on-year, of which in 2014, lithium-ion battery electrolyte accounted for less than 20%, 2015 power Lithium battery electrolyte accounted for 41.2%, and the proportion increased significantly. In 2016, China's power lithium battery electrolyte demand will reach 55,000 tons, an increase of 111%, power lithium battery electrolyte ratio will reach 62%; 2017 power lithium battery electrolyte demand will exceed 77,000 tons, an increase year-on-year More than 40%, the proportion of power lithium battery electrolyte will reach 59%; 2018 power lithium battery electrolyte demand will reach 100,000 tons, power lithium battery electrolyte ratio will remain at 60%.

In the Chinese market, the localization rate of electrolytes exceeds 80%, and the main domestic electrolyte manufacturers Xinqibang, Tianci Materials, Cathay Pacific, Zhuhai Saiwei, Shanshan, Tianjin Jinniu, etc. have a capacity of 20,000 tons in 2015. 18,000 tons, 10,000 tons, 10,000 tons, 0.8 million tons, and 0.8 million tons, the electrolyte faucet is also continuing to expand lithium salt production capacity. New Zeon has become a supplier to Samsung, Panasonic, Sony, ATL and BAK; Cathay Pacific has become a supplier to Panasonic, Sony, Maxell, Samsung, LG Chem, BYD and Lishen; Shanshan has become BYD, Lishen, ATL and Bick suppliers.

According to the new quarterly financial report data, the company's net profit increased by 71.62% over the same period. One of the main reasons is that lithium-ion battery chemicals benefited from the rapid development of the new energy automobile industry and the sales volume increased significantly. Tianci Materials' third-quarter 2016 financial report also showed that the company's net profit increased significantly during the same period, mainly due to the substantial increase in electrolyte sales and prices compared with the same period last year.

Entrepreneurial opportunities in the field of electrolytes may lie in the search for better electrolyte alternatives, lithium hexafluorophosphate has shortcomings such as poor thermal stability, and companies and research institutions are seeking new alternatives in recent years.

3, PACK and battery management

The process and technology of cell production are relatively mature, but the combination of cells in the power lithium battery puts higher requirements on the consistency of the cell, so the capital investment of the production equipment is also very large. Generally speaking, the construction of a lithium iron phosphate battery production line requires at least 50 million yuan of start-up capital. It is very difficult for start-ups to enter this field, and traditional battery manufacturers have advantages.

Start-up companies can use battery cells as an entry point to do battery management systems (BMS). BMS is the key to solving battery consistency, accounting for 1/10 of the cost of power lithium battery packs. Moreover, the industry believes that with the rapid mass expansion of new energy vehicles, the market scale of battery management systems will expand simultaneously. In 2020, the market size will reach more than 36 billion yuan, and the future prospects are broad. This link is easier to establish a competitive advantage than the upstream involves too much material.

However, combined with the analysis of the current industry status, the competition for BMS R&D and production is becoming more and more fierce, and there are also serious polarizations from a technical perspective. Some companies have mastered advanced battery management system technologies, such as Joyson Electronics, through their own research or acquisitions; while some new companies can only develop low-end BMS products. The choice of BMS by various OEMs is still different, which also brings development opportunities for the majority of BMS manufacturers.

However, as BMS security and quality issues are increasingly valued by consumers and government regulators, companies specializing in BMS business still have a first-mover advantage in this area. First of all, the core SOC estimation and battery equalization technology in the BMS field have considerable technical thresholds. At the same time, relevant enterprises that insist on the main business of BMS have accumulated a large amount of empirical data on BMS operation, which is of great significance for the later product improvement.

The domestic R&D and production of BMS is mainly concentrated in new energy vehicle manufacturers (BYD), battery PACK manufacturers (Watma, Pride, etc.), professional BMS manufacturers (Huizhou billion, Shenzhen Guoxin Power, etc.).

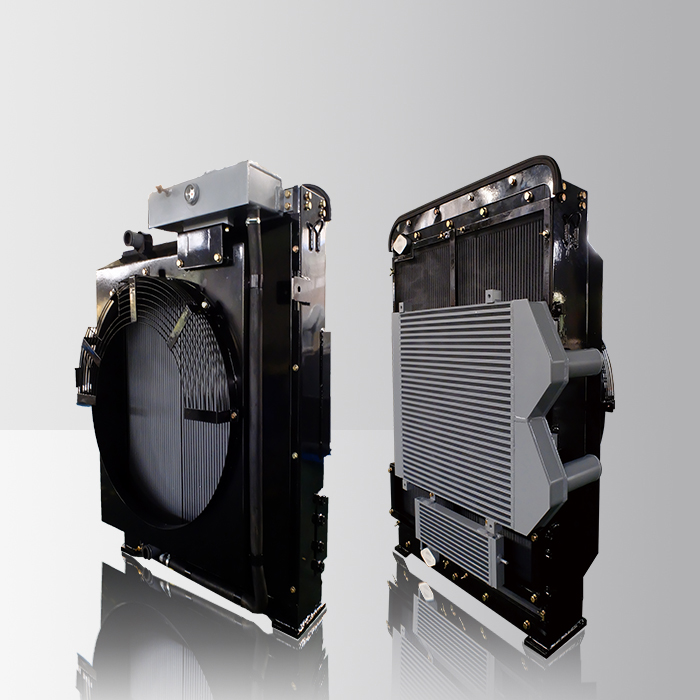

ThermicTransfer has 14 years of experience in R&D and production of engine radiators. The long-term cooperation engine brands are Yanmar/Cummins/Deutz/Perkins/Kubota/Isuzu/Mitsubishi/MTU. Our experience is based on the engine power provided by the purchaser. Performance curve, single heat dissipation or multiple combined heat dissipation requirements, we simulate the calculation of heat dissipation requirements, and design a three-dimensional cooler solution according to the engine size combined with the installation environment, provide customers with three-dimensional model confirmation, and provide performance parameter reports through simulation calculation. Finally, according to the customer's suggestion to adjust and optimize, form an effective program. We will then provide samples for performance testing, mass production through long-term performance, stress testing, resistance testing, etc.

At present, we design up to 5 combined Heat Exchangers for construction machinery, including two oil coolers, water cooler, Intercooler, and fuel heat exchanger.

Engine Heat Exchanger,Marine Engine Heat Exchanger,Marine Heat Exchanger,Fireplace Heat Exchanger

Xinxiang Zhenhua Radiator Co., Ltd. , https://www.thermictransfer.com